Graphic by Noah Dawson

If the gubernatorial debate between Greg Abbott and Beto O’Rourke last week was any indication, property taxes will be a key issue when voters head to the polls in November. However, while there are important differences between each of the gubernatorial candidates, the biggest decision regarding property tax bills across the state this fall probably won’t be made at the ballot box in November. Instead, it will likely be made in Potter County District this week.

To explain why, we first have to go back to the November 3rd election in 2020. While national attention was focused on the presidential election, a set of major ballot propositions was on the ballot in Amarillo, including Prop A, $319 million spending package focused on improvements to the Civic Center and other nearby city facilities. The project failed, with 61% of voters rejecting the proposal.

Though the project failed at the ballot box, the city government did not give up.

One part of the proposed project was a relocation of Amarillo City Hall, with renderings of the proposed project showing a new downtown park where City Hall currently stands. In 2021, less than a year after Prop A was defeated, Amarillo City Council voted 4-1 to continue with replacing City Hall at a price tag of $35 million. However, a petition and lawsuit put the move on pause. Then, in December of 2021, it was brought back again with a 3-1 vote. (Councilman Cole Stanley, elected in May of 2021, was the sole vote against the project on both occasions. Councilman Howard Smith was absent during the December meeting.)

While the city government has insisted that the City Hall project was not part of the $275 million bond portion of the Prop A package, there appears to be little evidence supporting this claim.

Then, in May of this year, Amarillo City Council voted 4-1 (Cole Stanley was again the only vote against the project) to fund improvements to the Civic Center at a price tag of $260 million, using anticipation tax notes under Texas Government Code Chapter 1431. This funding mechanism is typically reserved for emergency infrastructure improvements, with the next largest issuance of this form of debt issued by San Antonio in 2007, when they issued $60 million for fire stations, drainage systems, and flood control.

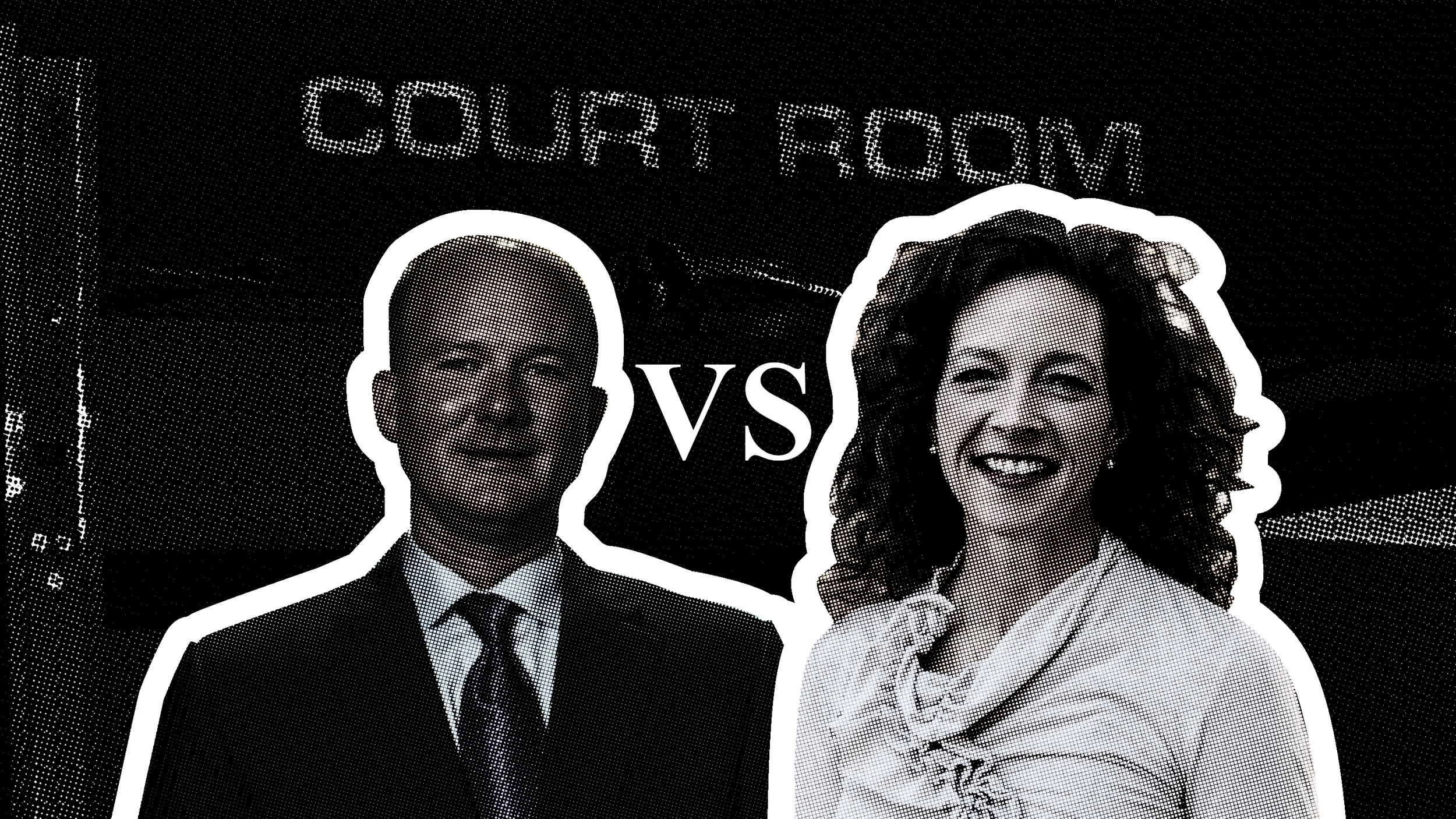

This caught the ire of many in Amarillo who felt this was a way for the city government to go around the will of voters. A few days after the council voted on the measure, businessman Alex Fairly of the Fairly Group sued the city. Shortly after Fairly filed his suit, the city filed their own suit asking for courts to give an expedited judgment declaring the debt issuance was legal.

While the city’s policy is to not speak on ongoing legal cases, Mayor Nelson did defend the vote by noting plans by the Federal Reserve to increase interest rates, arguing that if the city chose to approve the project at a later date, the interest payments would be costlier. This framing of the issue, however, was somewhat at odds with views expressed by most economists, who had predicted that the Federal Reserve would increase interest rates in summer of 2022 months before Mayor Nelson deemed the looming rate hikes were part of why passing the item constituted an emergency.

The two lawsuits were combined during a hearing on July 5th. Overseeing that hearing and now combined lawsuit is retired Judge William Sowder from Plainview, with Judge Pamela Sirmon having recused herself. Also in contention during the hearing were the level of discovery, if the trial would include a jury, and when the trial would take place.

On those matters, Sowder ruled in favor of Fairly’s request for expanded discovery, allowing him to request a wider array of documents and depositions. On the matter of allowing a jury, Sowder ruled in favor of the city by denying a jury trial. On the matter of the date of the trial, Sowder ruled between the two requests. While the city wanted the trial to occur within a few weeks and Fairly wanted the trial to occur many months later, Sowder set October 4th as the starting date of a two-day trial. (Since then, all parties have expressed being open to continuing the trial beyond two days if necessary.)

The parties then met for another hearing on July 21st, after the city requested Alex Fairly pay a $6 million security against suit bond to remain a party to the lawsuit. According to the city’s arguments, Fairly’s lawsuit caused the issuance of the debt to be delayed, costing the city money if the city ends up being victorious. However, Fairly argued during the hearing that, due to possible violations of the Texas Open Meetings Act, Fairly had a good chance of winning the case at trial. During the hearing, Amarillo Assistant City Manager and Chief Financial Officer Laura Storrs was called as a witness. During her testimony, it was shown that the agenda item from the meeting when the debt was voted on characterized the item as being “revenue and tax notes,” implying the city planned to fund at least part of the project with revenues other than taxes. Storrs admitted that the city did not have plans to use funding streams other than taxes to pay for the project, though she claimed that the erroneous agenda item was a typo which was not intended to mislead the public.

Fairly’s legal team also argued that the Texas Attorney General’s Office had not yet approved the debt issuance. In Texas, the Attorney General’s Office must approve all debt issuances by local governments before the debt is officially issued. Because of this, Fairly’s team argued, the cause of any delay could not be blamed on Fairly.

Sowder ruled in favor of Fairly, allowing the case to move forward without requiring Fairly pay the $6 million bond.

Then, in August, a petition was filed with the city seeking to overturn the ordinance by the city approving the tax notes. While separate from the lawsuit, Fairly supported the petition drive, collecting signatures at his office. The petition garnered the requisite number of signatures in record time, according to organizers. After submitting the petition to the city, it was expected that the city would verify the signatures then submit the issue to the city council. The council would then have an opportunity to repeal the ordinance. If they declined, the organizers would then have the opportunity to request the item be placed on the May ballot.

However, the city rejected the petition, claiming several technical deficiencies.

Despite the petition’s setback, the trial was still set to move forward. Ahead of the Trial, Mr. Fairly travelled to Austin to testify before committees of both the state house and senate. The situation in Amarillo was met with shock from state lawmakers, signaling that, regardless of the outcome of the trial, legislation pertaining to the issue will likely be filed during the upcoming session.

There is good reason for the state to focus on the issue: Since Prop A was defeated in Amarillo, over $16 billion worth of other bonds have been rejected by voters across the state. If the city prevails in court this week, it is not unthinkable that other taxing entities across the state will model anticipation notes after Amarillo’s.

The City of Amarillo has already had one response to the delayed causing a change in policy: For the first time since 2006, the city reduced the property tax rate. While the rate will still be an effective increase due to increased appraisal values, the rate had been planned to be higher to begin servicing the debt for the civic center project. However, after Councilman Cole Stanley pushed the council to consider removing that portion of the rate, it was eventually removed.

The parties to the suit then met for a virtual pre-trial “housekeeping” hearing last week, where several matters were decided. Sowder ruled against a renewed motion by Fairly’s team for a jury trial. He also ruled against Fairly’s team in a request for the court to review several emails the city had refused to hand over, with the city claiming the emails were protected by attorney client privilege.

During the hearing, the city requested Judge Sowder to instruct the parties to not confront witnesses with allegations regarding deficient compliance with discovery. Sowder Denied the request. Judge Sowder also did not give instructions regarding limitations on opening and closing statements or questioning of witnesses, noting that, thus far, both legal teams “have done an excellent job.”

The trial is set to begin at 9:00 am on Tuesday, October 4th, in Potter County District Court. The trial will take place in person, though space is limited in the courtroom. It will also be live streamed on YouTube on the “32th District Court, Potter County” channel.

One person who is not expected to be able to attend the trial is Alex Fairly himself, who was injured in a biking accident in Arkansas last Thursday.

The Amarillo Pioneer will be reporting on the trial on our website and on Twitter (@AmaPioneer).